How to Outsource Your Bookkeeping Bench Accounting

Hiring a local or online bookkeeper is a more cost-effective solution, and you’ll get year-round support with your finances. This means access to invaluable financial data that can help you stay on top of your cash flow and guide your decision-making. Then you can turn to accounting firms and tax professionals for what is the journal entry for sale of services on credit just tax preparation, reducing your overall costs. Furthermore, outsourced bookkeepers can help streamline your invoicing and payment processes, ensuring timely collection of receivables and efficient disbursal of payables.

Explore opportunities with innovative companies and build a fulfilling career as a skilled professional at the forefront of the industry. FreshBooks can help you find an online accountant nearby who is ready to help your endeavour grow and succeed and fulfil all your accounting needs. As alluded to in the previous step, outsourcing isn’t a “set it and forget it” solution. As your business changes or grows, continuously assess whether the agreement is continuing to meet your business needs.

- Having a virtual bookkeeper means that someone else does the books on your behalf online.

- Whether you’re a small business owner or the head of a large organization, this guide will provide you with the knowledge and tools you need to make an informed decision about outsourcing your bookkeeping.

- The global business process outsourcing market worth is projected to reach an all-time high of $405.6 billion by 2027.

- Businesses can eliminate unnecessary back-and-forth between different departments or external service providers by integrating these functions.

The Benefits of Outsourcing Software Development for Companies: A Strategic Approach

That means cost will most likely scale with the size of business and financial accounts, so small businesses will pay less than enterprises for these services. Experienced bookkeepers are often better at finding overdue clients and cuts your company could make to increase overall profit. Plus, having an outsourced bookkeeper is more cost-efficient in the first place, since you’re not technically their employer. Outsourced bookkeeping services are a symbiotic relationship between your business and a third party that will balance your books. Though the process might look different for small vs. big businesses, the steps will generally be the same. Bookkeepers use an accounting journal or an online accounting program to keep track of each transaction and the purpose of the transaction.

Their expertise in tax matters not only simplifies the process but also ensures compliance and accuracy, potentially leading to cost savings and a smoother tax filing experience. Having an outsourced bookkeeping service provider is known to reduce many common errors made by business owners. Modern bookkeeping is often done through a cloud-based automated system that allows you and other experts to view your records at any time, so there are many eyes on your books. This leaves little room for error, especially considering outsourced bookkeepers are highly trained, so there is no adjustment period needed. This can improve your peace of mind that your bookkeeping needs are being well taken care of.

This leads to better financial health and supports the achievement of business objectives. Bookkeeping software is integral to outsourced bookkeeping services, offering tools for accurate transaction logging, financial reporting, and tax preparation. Advanced software like QuickBooks Online allows for real-time data access and seamless integration with other financial systems. This technology enhances the efficiency and reporting and analyzing current liabilities accuracy of the bookkeeping process, enabling businesses to receive timely and precise financial insights, which are crucial for making informed decisions.

Step 1 – Prepare the Business for Outsourcing

Consider the value proposition of outsourcing – it allows you to access professional expertise without the cost of a full-time in-house bookkeeper. Determine how much you are willing to invest in outsourcing, keeping in mind that quality and reliability should be prioritized over low-cost providers. For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month. Then, our platform lets you track your finances, download financial statements for your accountant, and message your bookkeeping team. These experts, with their high level of skill and established systems, make fewer mistakes than training a new employee. This leads to more accurate and reliable financial records, ensuring better overall financial management.

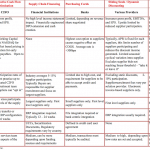

First, analyze your accounting operations and determine which functions you’d like to outsource. Consider factors such as time spent on certain tasks, the level of expertise required, and the costs of performing these tasks in-house. When you outsource, you’re tapping into decades of experience and expertise across multiple facets of accounting. This ensures you’re getting the best support and advice on a range of financial matters, from tax planning to financial forecasting and budgeting. For more detailed services like financial analysis and payroll, mid-range plans are around $100 to $750. They handle the day-to-day recording of financial activities, like tracking sales and expenses, and make sure every transaction is accurately entered into the company’s accounting system.

Determine which accounting functions to outsource

This ensures that your tax and what is financial accounting legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified. It helps in managing finances efficiently, ensuring compliance, and allowing businesses to focus on core activities as well as ensuring you have the right expertise to manage your business finances. For larger businesses or those with complex finances, high-end plans cost more than $1000. Outsourcing bookkeeping is often a better choice financially for many businesses, especially smaller ones. When you outsource, you pay only for the services you need, which can be less expensive than a full-time bookkeeper’s salary and benefits.

Typically, there are a few signs that it’s time to leave the DIY behind and bring on a professional. However, this can be mitigated significantly by choosing the right accounting partner and building a positive relationship. However, if there is anything in the provider’s agreement that you’re uncomfortable with, don’t hesitate to challenge it or move on to another provider. Once you’ve established what you want to outsource, the next next step is to identify who you’re going to outsource it to. To learn more about how Remote can make your payroll operations quick and simple, check out our in-depth payroll processing guide. As a result, it’s helpful to understand what you might want to outsource, and what you might want to keep in-house.

Categories:

Categories:  Tags: |

Tags: |